A Comprehensive Guide to Long-Term Incentive Plans

Explore how LTIPs attract, retain, and motivate employees. Plus, learn best practices for designing and managing effective LTI programs.

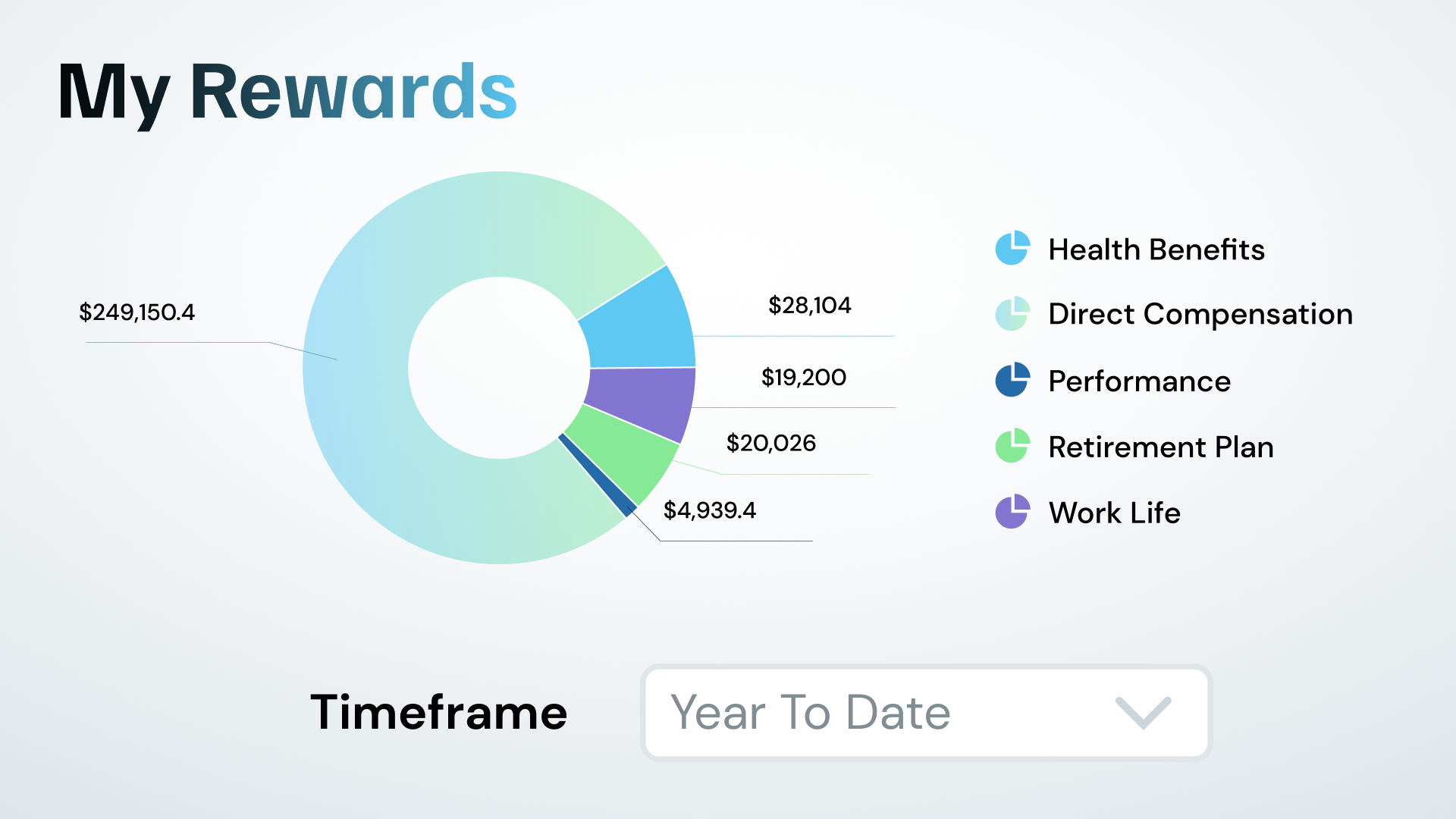

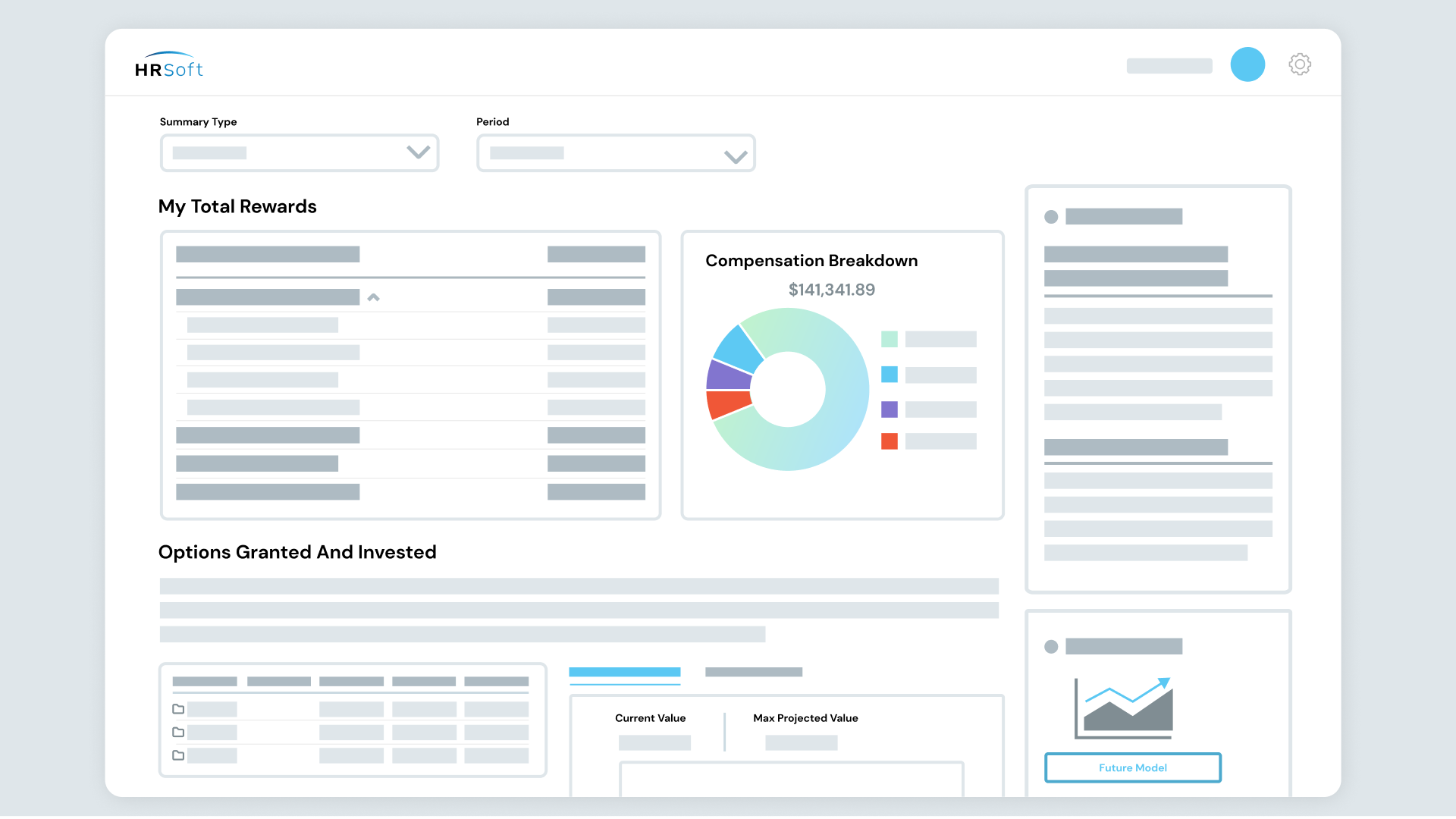

Simplify equity compensation management with HRSoft. Our long-term incentive (LTI) management software promotes transparency and connects employees to company performance and strategy, ensuring your organization’s investment is optimized.

Automate the creation and distribution of LTI agreements through a configurable planning and award system. Enhance decision-making with data-driven insights derived from historical performance and other relevant data aligned with your compensation philosophy.

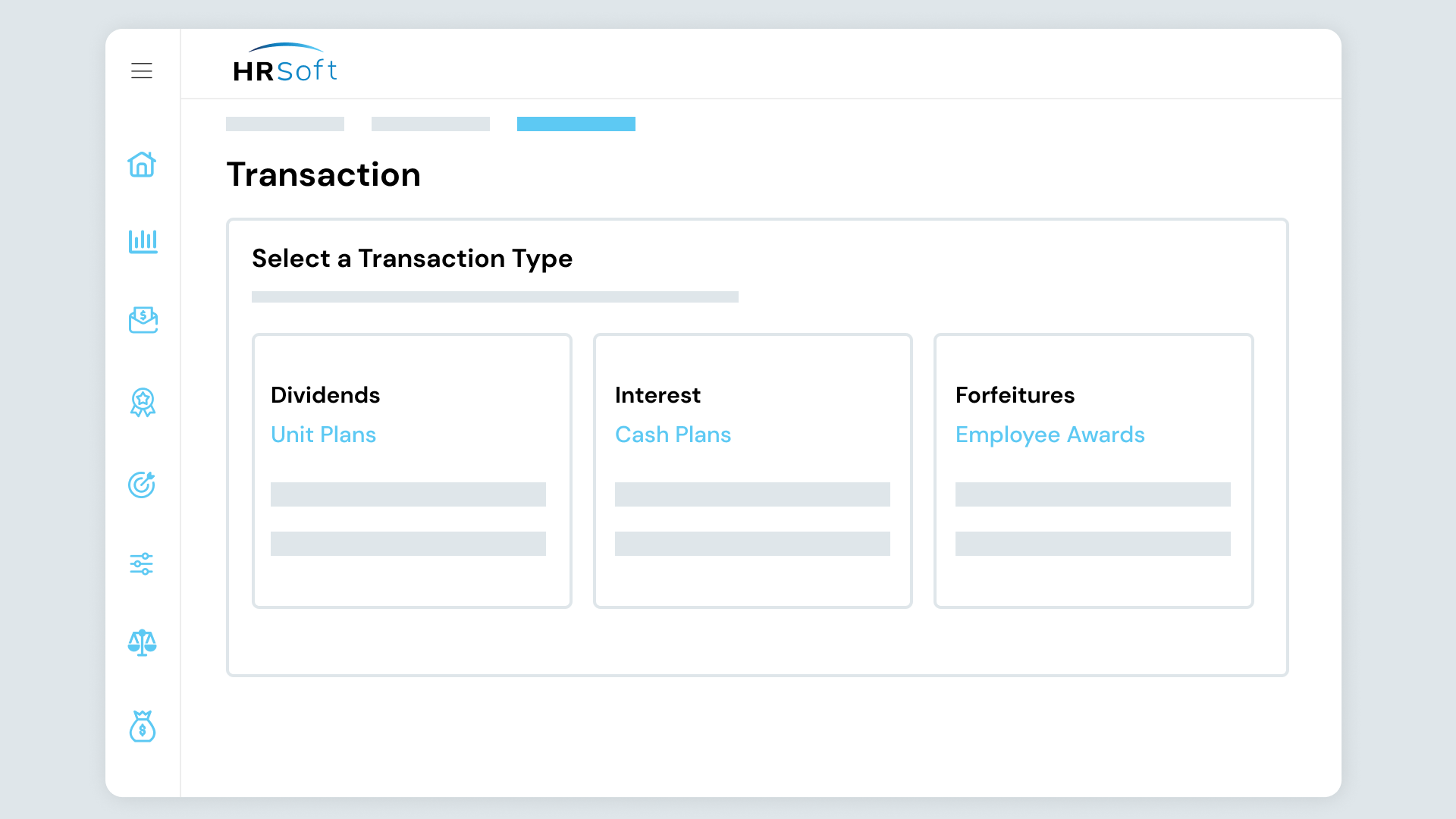

Deferred compensation arrangements help to align employee interests with the long-term success of your organization. Use HRSoft to set up deferred compensation for any type of reward:

Whether you want to offer cash-based awards, stock-based awards or both, use HRSoft’s highly configurable LTI software to make it happen. HRSoft can automate the entire LTI process for any deferred cash or phantom stock program.

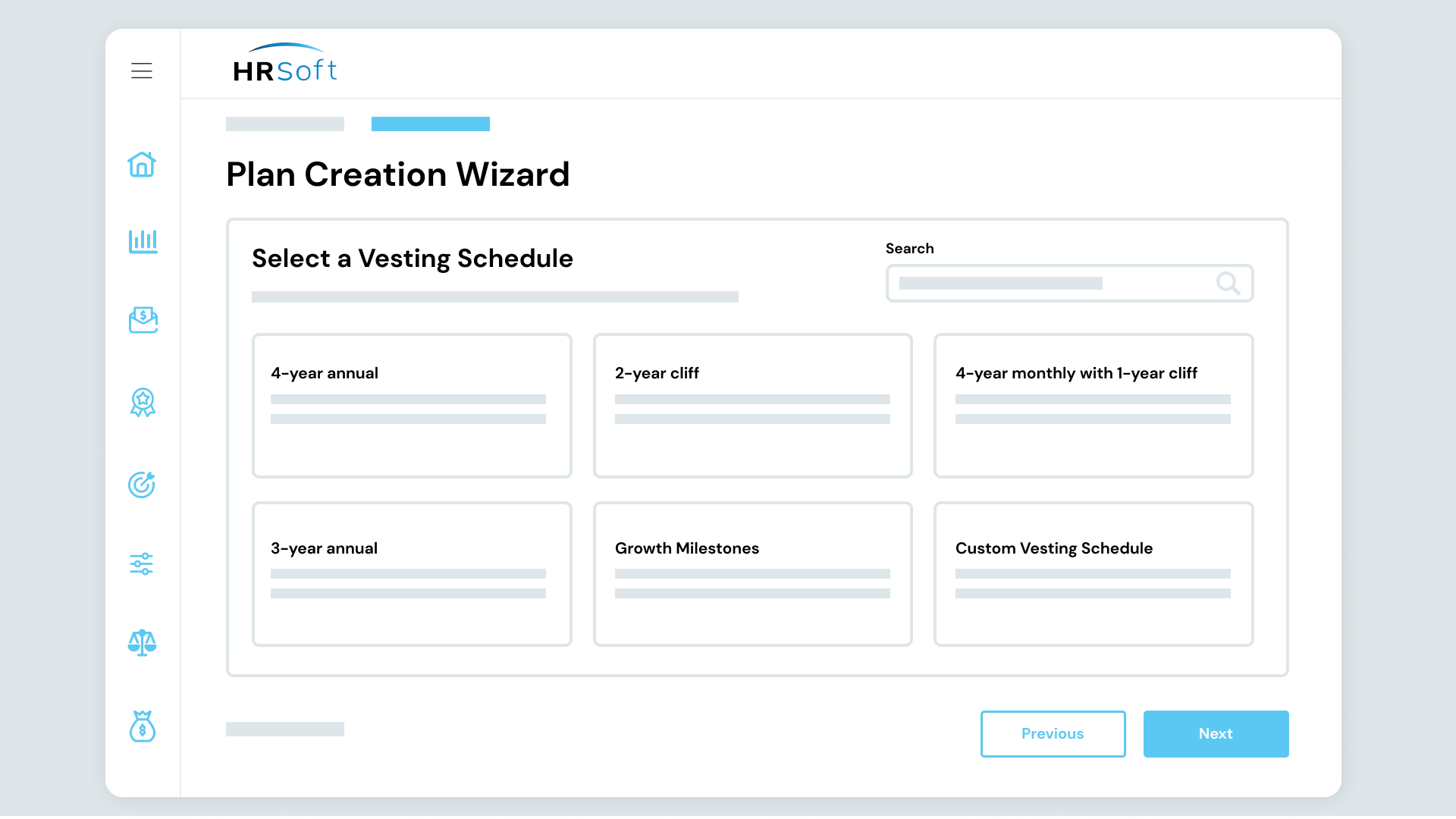

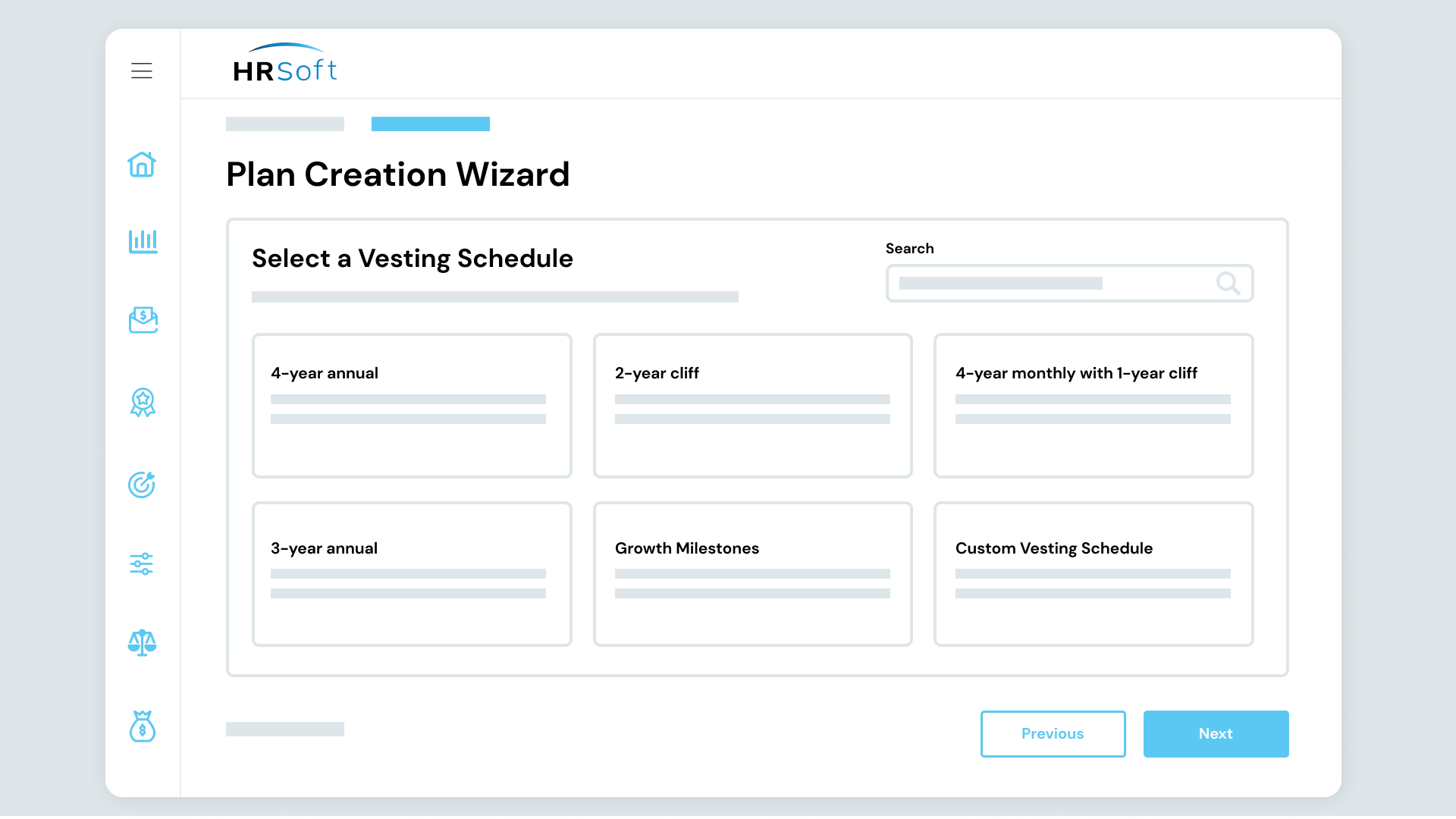

Monitor the progression of the vesting schedule with HRSoft’s user-friendly dashboard. You can also manage the timeline and conditions under which LTI awards become vested, and calculate the final value of an award with multiplier processing.

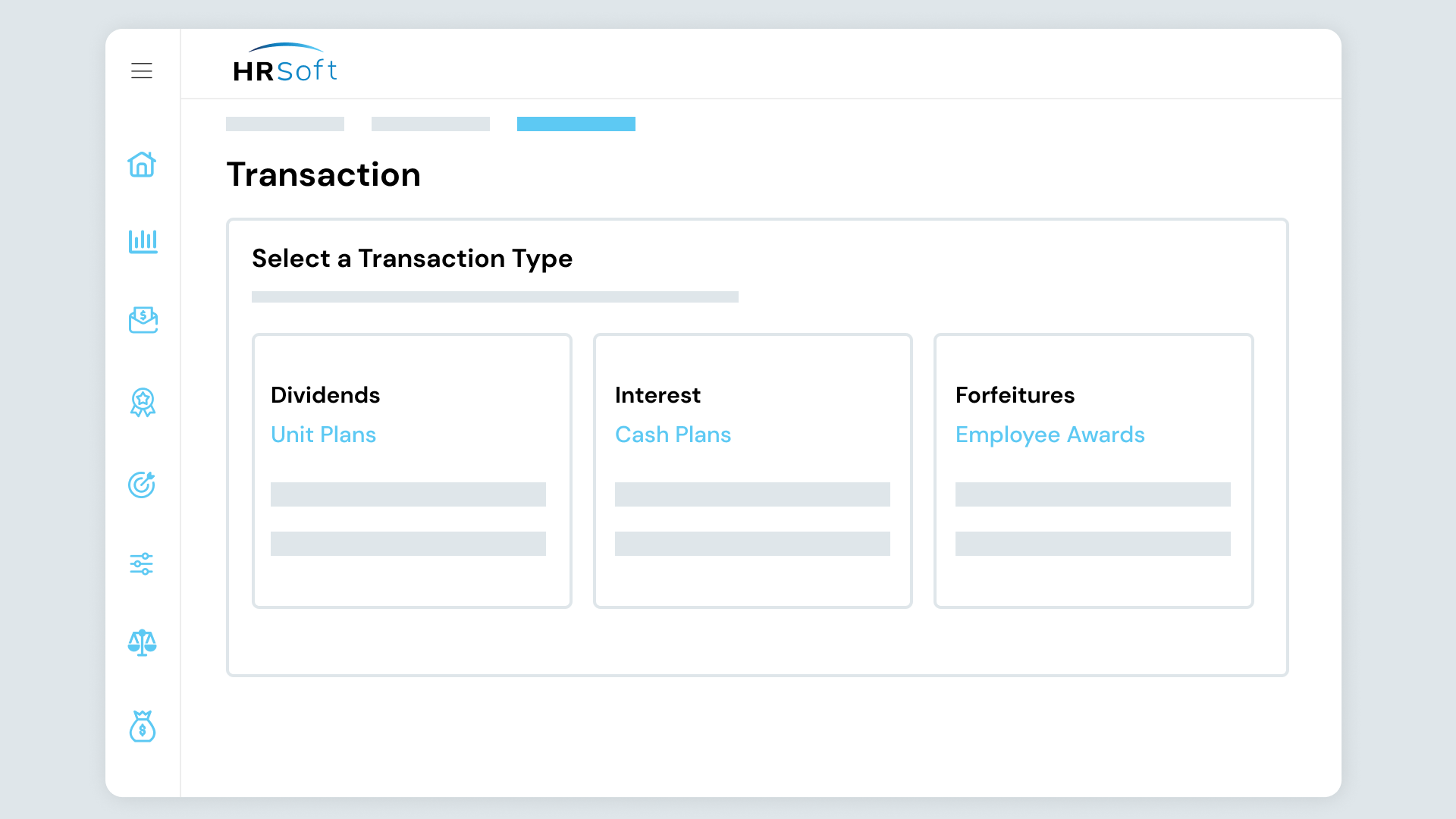

Effectively mitigate risk, enhance transparency and maintain the integrity of your LTI program by letting HRSoft automate the enforcement of forfeiture conditions:

HRSoft makes it easy to allocate LTI rewards through a streamlined process:

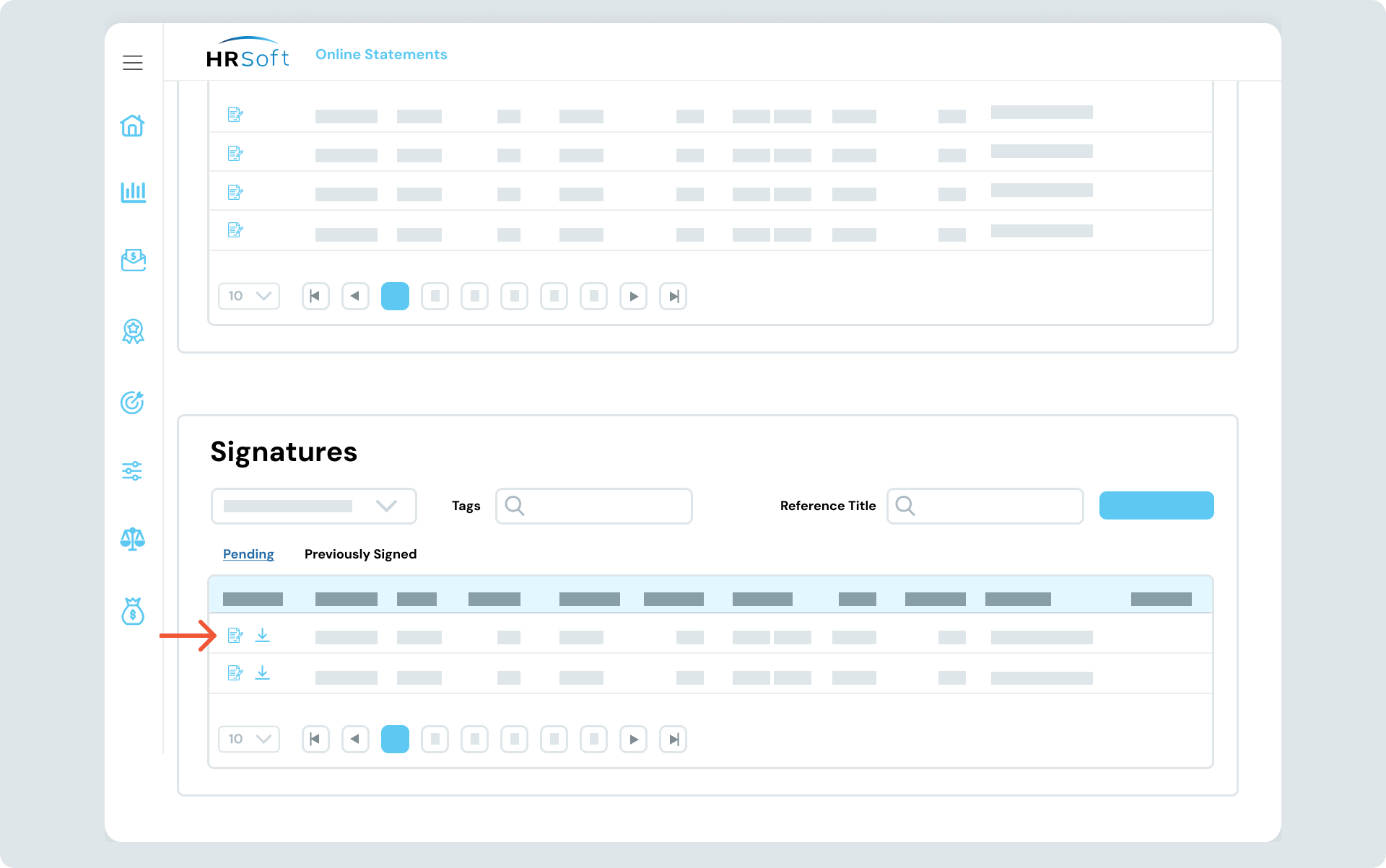

Secure legally compliant digital signatures for equity, long-term incentive and deferral agreements with Docusign.

Explore how LTIPs attract, retain, and motivate employees. Plus, learn best practices for designing and managing effective LTI programs.

Your employees are more than the sum of their parts. That is to say that they are actively involved in driving initiatives and attaining objectives

Give your team the tools they need to make better compensation decisions from day one.

Long-term incentives (LTIs) are rewards or benefits designed to motivate and retain individuals over an extended period by aligning an employee’s interests with the organization’s long-term success.

Long-term incentives include stock options, restricted stock units (RSUs), performance shares and cash bonuses.

Long-term incentive plans (LTIPs) typically tie rewards to achieving specific long-term goals and the company’s sustained success. The effectiveness of LTIPs lies in aligning the interests of employees or executives with the organization’s overall objectives, fostering a sense of commitment and ownership. Participants benefit from these incentives as they contribute to the company’s success over time, while the organization gains a motivated and dedicated workforce focused on achieving its long-term strategic goals.

Long-term incentive management software is designed to optimize and streamline the complex processes associated with LTIPs within organizations. It offers a centralized platform for plan administration, allowing for efficient tracking of grant details, vesting schedules and participant performance against predetermined metrics. LTI management software helps automate routine tasks, such as calculating award values, tracking vesting periods and generating reports. It also communicates plan details to participants, ensuring transparency and understanding.

Designing a successful long-term incentive plan (LTIP) involves a strategic and thoughtful approach to aligning employee interests with the organization’s long-term goals. The first step is to define clear and measurable performance metrics that directly contribute to the company’s success. Whether it’s financial targets, stock price growth or specific operational milestones, these metrics should reflect the company’s strategic priorities.

Next, select the appropriate incentive vehicles, such as stock options, restricted stock units (RSUs) or performance shares, based on the organization’s objectives and the desired impact on participant behavior. Establishing a fair and motivating vesting schedule is crucial to retaining talent, with longer vesting periods often used to promote loyalty. Communication is key throughout the process, ensuring that participants understand the plan’s structure, objectives and how their performance directly influences their rewards.

The LTIP should be regularly evaluated and adjusted based on organizational performance and industry benchmarks. Also, collaborate with legal and financial experts to navigate regulatory and tax considerations.

Long-term incentives are taxed depending on the specific type of incentive and the applicable tax regulations in the relevant jurisdiction. For stock options, the gain from exercising options and selling shares may be subject to capital gains tax. Restricted stock units (RSUs) are generally taxed at the time of vesting, with the value of the vested shares considered taxable income. Performance shares, when they vest and payout, may also be treated as taxable income. Cash bonuses tied to long-term performance are typically taxed in the year they are received. Retirement plans and pension benefits may be subject to income tax upon distribution.

Individuals receiving LTIs should consult with tax professionals or financial advisors to understand the specific tax implications based on their circumstances and the prevailing tax laws, which are subject to change.

Equity management is the strategic administration and oversight of an organization’s equity-related instruments, such as stocks, stock options, and other forms of ownership stakes. This includes implementing and managing equity-based compensation plans for employees and executives, as well as the overall governance of equity ownership within the company. Equity management involves granting, tracking, and administering stock options or restricted stock units (RSUs), ensuring compliance with regulatory requirements, and aligning equity programs with the company’s goals and financial strategies. The goal is to effectively utilize equity to attract and retain talent, align employee interests with organizational success, and foster a sense of ownership among stakeholders.

Deferred compensation is an arrangement between an employer and an employee where a portion of the employee’s earnings is set aside and paid out at a later date, typically after the occurrence of a specific event or upon reaching a predetermined milestone, such as retirement. This form of compensation allows employees to defer the receipt of a portion of their income, providing them with financial flexibility and potential tax advantages. Common forms of deferred compensation include deferred bonus plans, stock options with delayed exercise and retirement savings plans.

Executive compensation refers to the financial rewards and benefits provided to top-level executives within an organization, typically including the CEO, CFO, and other senior management positions. This comprehensive package goes beyond the base salary and may include various elements such as bonuses, stock options, restricted stock units (RSUs), performance shares and other long-term incentives. The objective of executive compensation is to attract, retain, and motivate highly skilled leaders while aligning their interests with the long-term success of the company.

Profit sharing is a compensation arrangement in which a company shares a portion of its profits with its employees. This approach involves distributing a percentage of the company’s profits among the workforce, providing employees with a financial stake in the company’s success. The distribution of profits can take various forms, including cash bonuses, contributions to retirement plans or allocations of company stock.