How Technology Is Rewriting the Rules of Growth for Private Equity Firms

Technology is changing how private equity firms grow. Learn how to ease compliance and streamline compensation without growing your headcount.

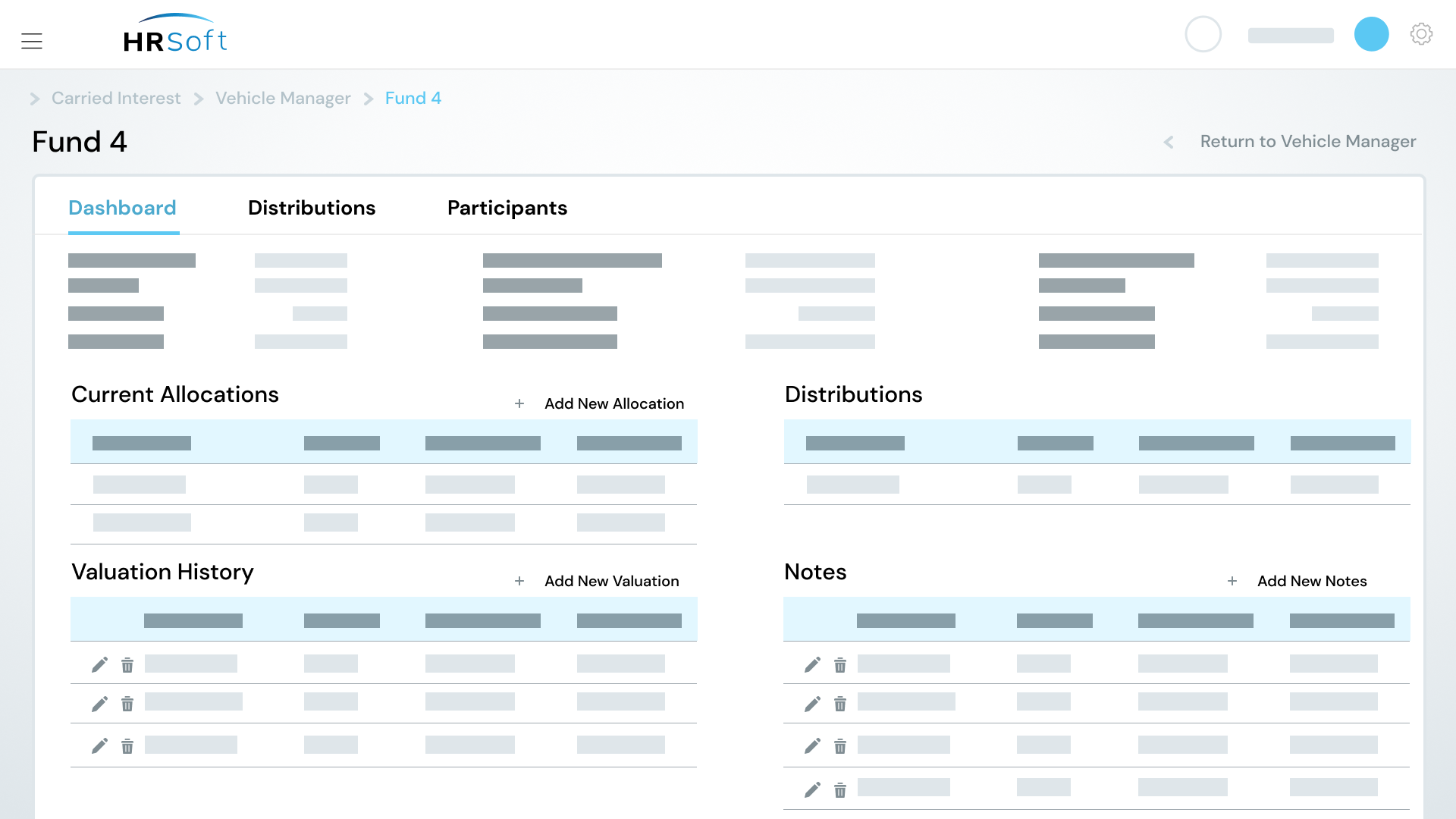

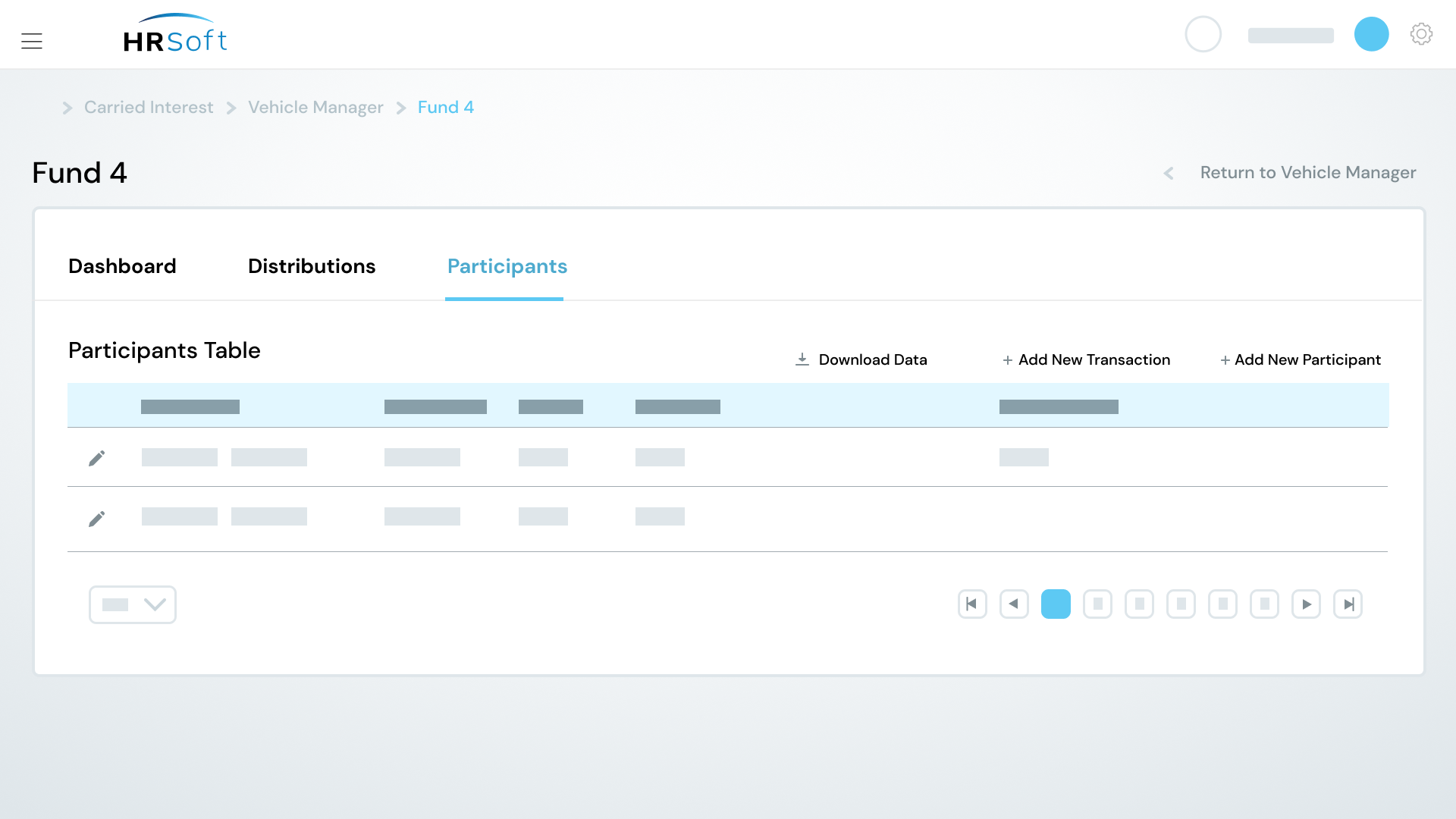

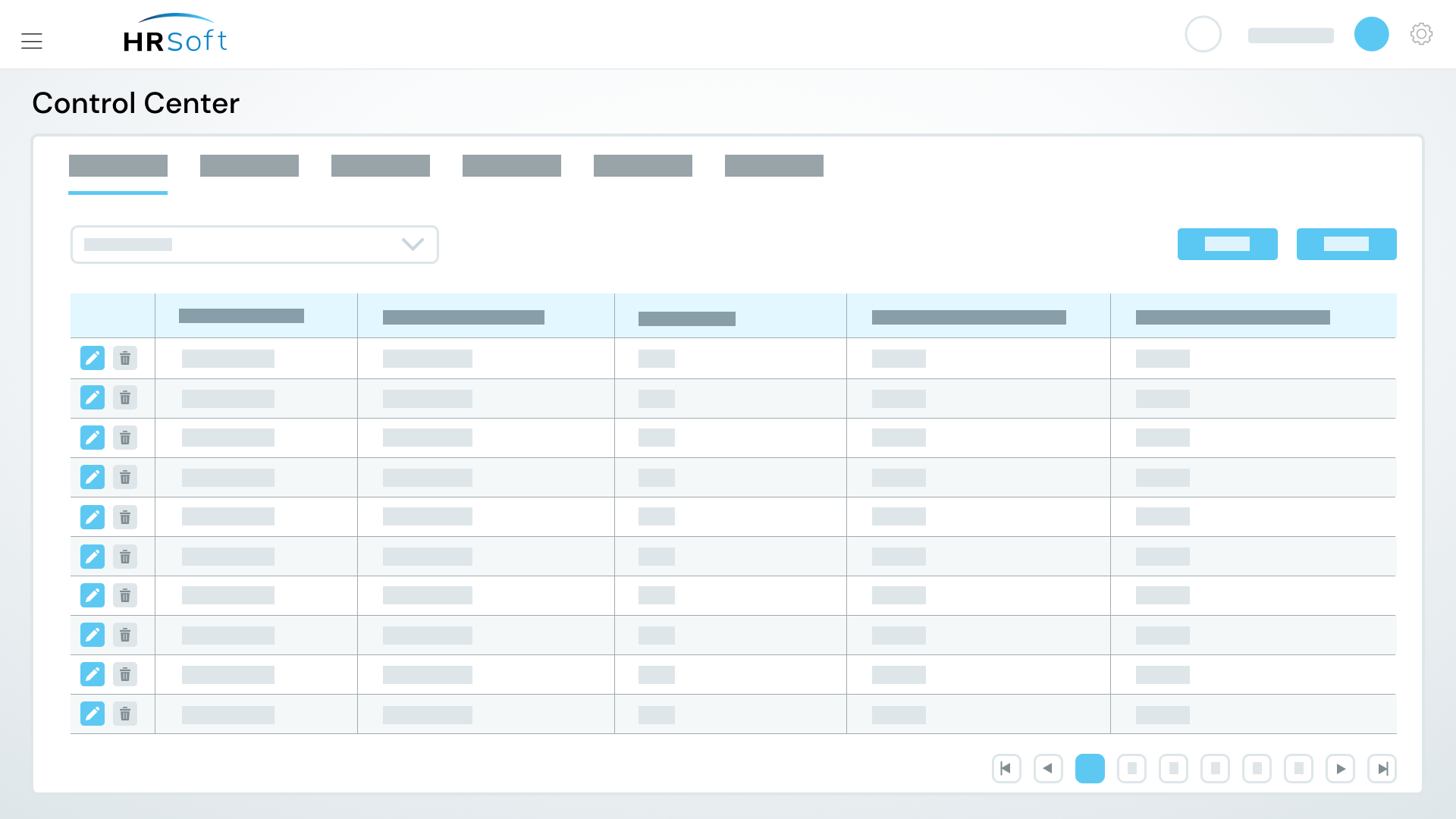

Manage ownership allocation and capital events while tracking your carried interest and co-invest programs with carried interest management software. Review details, update accounts and integrate new touchpoints.

Reduce the manual burden of report generation and processing with HRSoft. Our self-serve participant portfolio includes:

Each level of your firm needs specific data that answers their questions. HRSoft’s carried interest software for private equity and asset management has various options, including partner, fund and deal-level reporting.

Prepare forecasts and reports within one convenient platform and save data to be reviewed at a future date.

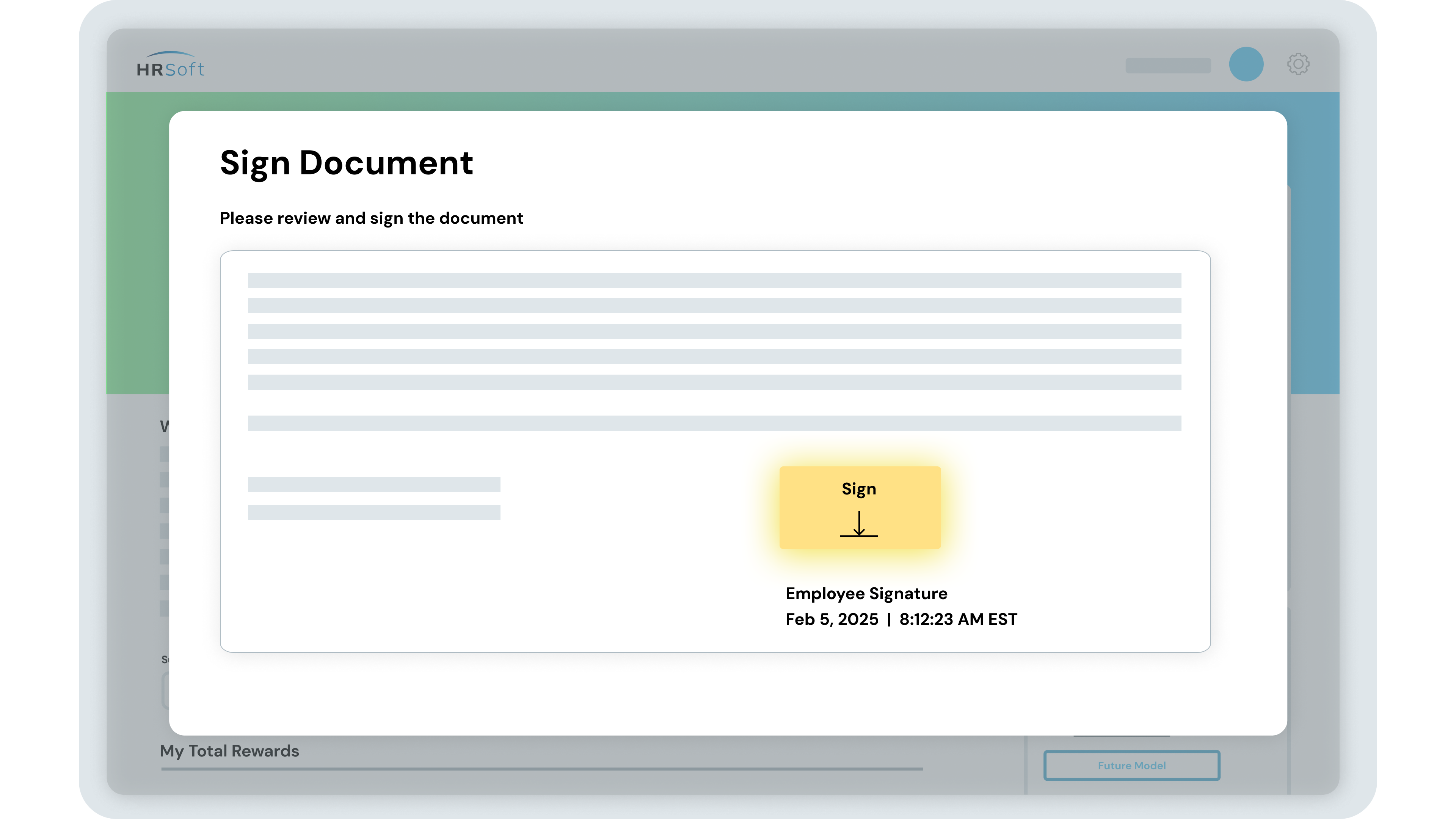

Easily get digital signatures for carried interest and partnership agreements with Docusign.

Technology is changing how private equity firms grow. Learn how to ease compliance and streamline compensation without growing your headcount.

Today’s employees want more than a paycheck. Learn how HRSoft helps companies make total rewards more meaningful and built for growth.

Learn how key compensation trends drive workforce automation to boost efficiency, transparency, and employee engagement.

Give your team the tools they need to make better compensation decisions from day one.

HRSoft supports fund-level, deal-by-deal, tranche, vintage and hybrid plans.

Our highly configurable software can also be used for multiple vesting schedules, participant management, realization and distribution processing. Accommodate joiners and leavers within your plans and implement updates as needed.

Carried interest is a form of incentive compensation commonly used in investment management, particularly in private equity and venture capital settings. It operates by aligning the interests of investment managers with those of the investors in the fund they manage.

When investors pool their capital to form an investment fund, the managers use this capital to make investments across various assets with the aim of generating returns over a specified period. Carried interest is then calculated as a percentage of the fund’s profits, typically after a hurdle rate or preferred return for investors has been met.

This performance-based compensation model motivates managers to make sound investment decisions that surpass the hurdle rate, as they only receive carried interest when investments perform well. This setup fosters a direct financial stake for managers in the success of the investments, creating an alignment of interests between managers and investors.

When investments are liquidated, profits are distributed based on the fund’s agreement, with a portion going to investors and the remainder, including carried interest, shared between investors and managers.

Carried interest management software is a specialized tool designed to assist investment management firms in calculating, managing and tracking carried interest distributions. It streamlines the complex process of determining the share of profits that investment managers are entitled to receive based on the performance of the investment fund they manage.

The primary beneficiaries are the employees and the company’s stakeholders, including shareholders and investors. Employees benefit by receiving additional compensation tied to the company’s performance, which motivates them to work towards achieving higher returns. This structure also aligns the interests of employees with those of the company and its stakeholders, fostering a culture of accountability and performance-driven outcomes.

Carried interest is typically taxed as capital gains in many jurisdictions, including the United States. This means that the profits derived from carried interest are subject to the capital gains tax rate rather than the ordinary income tax rate. The rationale behind this tax treatment is that carried interest is seen as a return on investment or a share of the investment profits, similar to gains from buying and selling assets like stocks or real estate.

Carried interest is typically paid to investment managers or general partners (GPs) after certain conditions or milestones are met. It is usually linked to the performance of the investment fund they manage. The timing of carried interest payments can vary depending on the fund’s structure and the terms outlined in the agreement.

An employee works at an investment firm and manages a fund. Their contract says they get 10% of the fund’s profits as carried interest if it makes at least a 12% return for investors.

After three years, the employee’s fund has done really well and made $10 million in profit, exceeding the 12% target. After expenses, there’s $8 million left for distribution. The employee’s carried interest comes out to $800,000.

The firm gives $6 million to investors, the employee gets $800,000 as carried interest, and the rest covers fees and expenses.

Asset management involves overseeing and optimizing a portfolio of assets, such as stocks and bonds, to achieve specific financial goals. It includes activities like investment selection, portfolio diversification, risk management and performance monitoring to maximize returns while minimizing risks for investors or organizations.

Alternative investments are non-traditional assets that diverge from traditional stocks, bonds, and cash. They include investments like private equity, hedge funds and real estate, offering potential for higher returns but often with increased complexity and risk compared to traditional investments.