A Quick Take: The Impact of the UK’s New Tax Laws on Carried Interest Compensation and Private Capital Firms

Learn how the UK’s latest tax laws aim to change carried interest compensation and how the proposed strategy will impact capital firms.

Managing carried interest doesn’t have to be complicated. With HRSoft, firms can reduce manual work, eliminate errors, and give partners real visibility into their investments. Our platform automates the end-to-end management of carry from allocations to complex calculations, vesting and reporting, so you can focus on driving performance and building stronger relationships with stakeholders.

Replace risky, error-prone spreadsheets and manual tracking with fully automated carry tracking and vesting logic. HRSoft comes with end-to-end audit trails for total peace of mind.

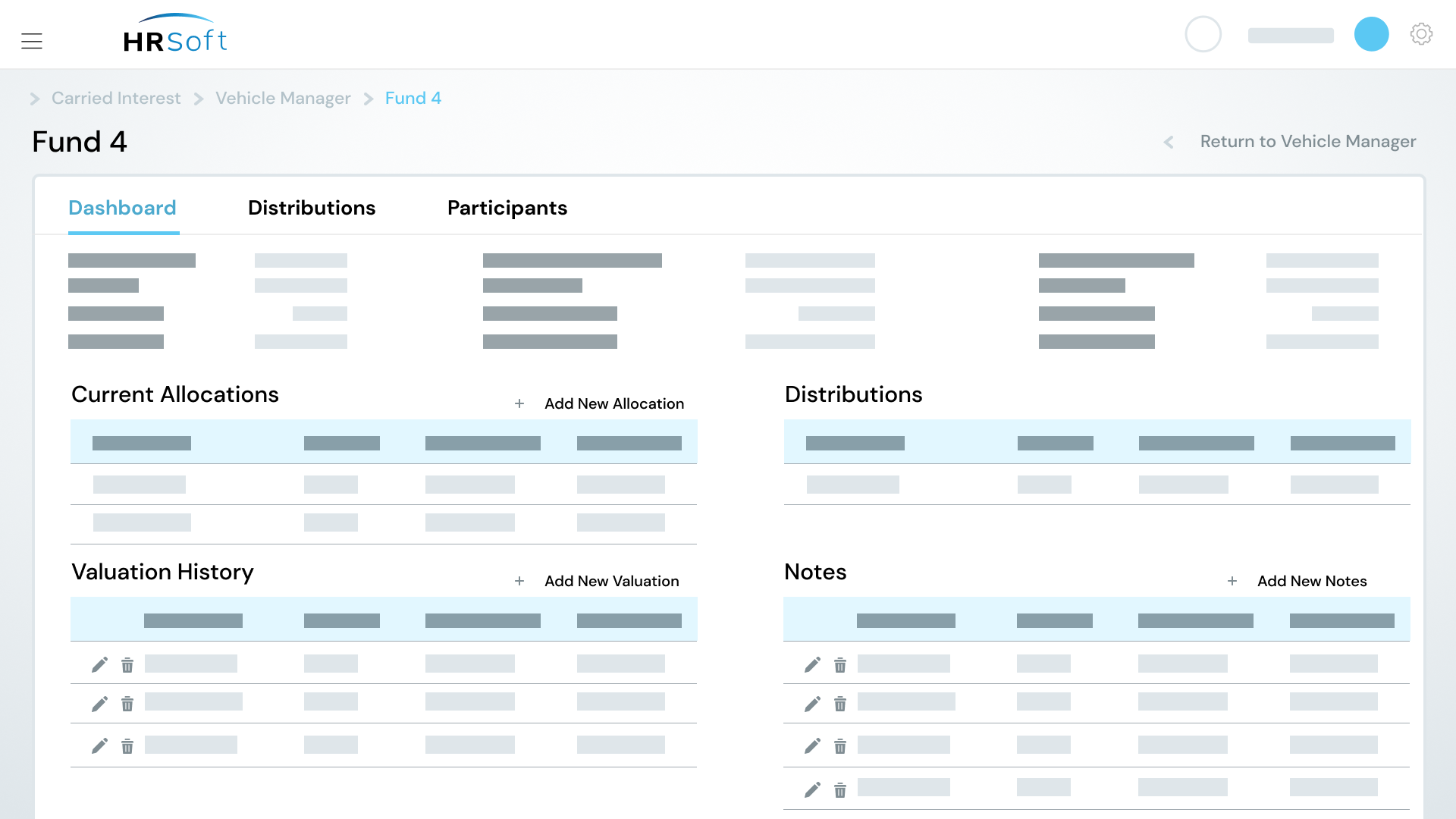

Deliver real-time dashboards and reports with role-based access controls and enterprise-grade security. Each stakeholder, from legal to fund ops to GPs, sees only the data they need, exactly when they need it.

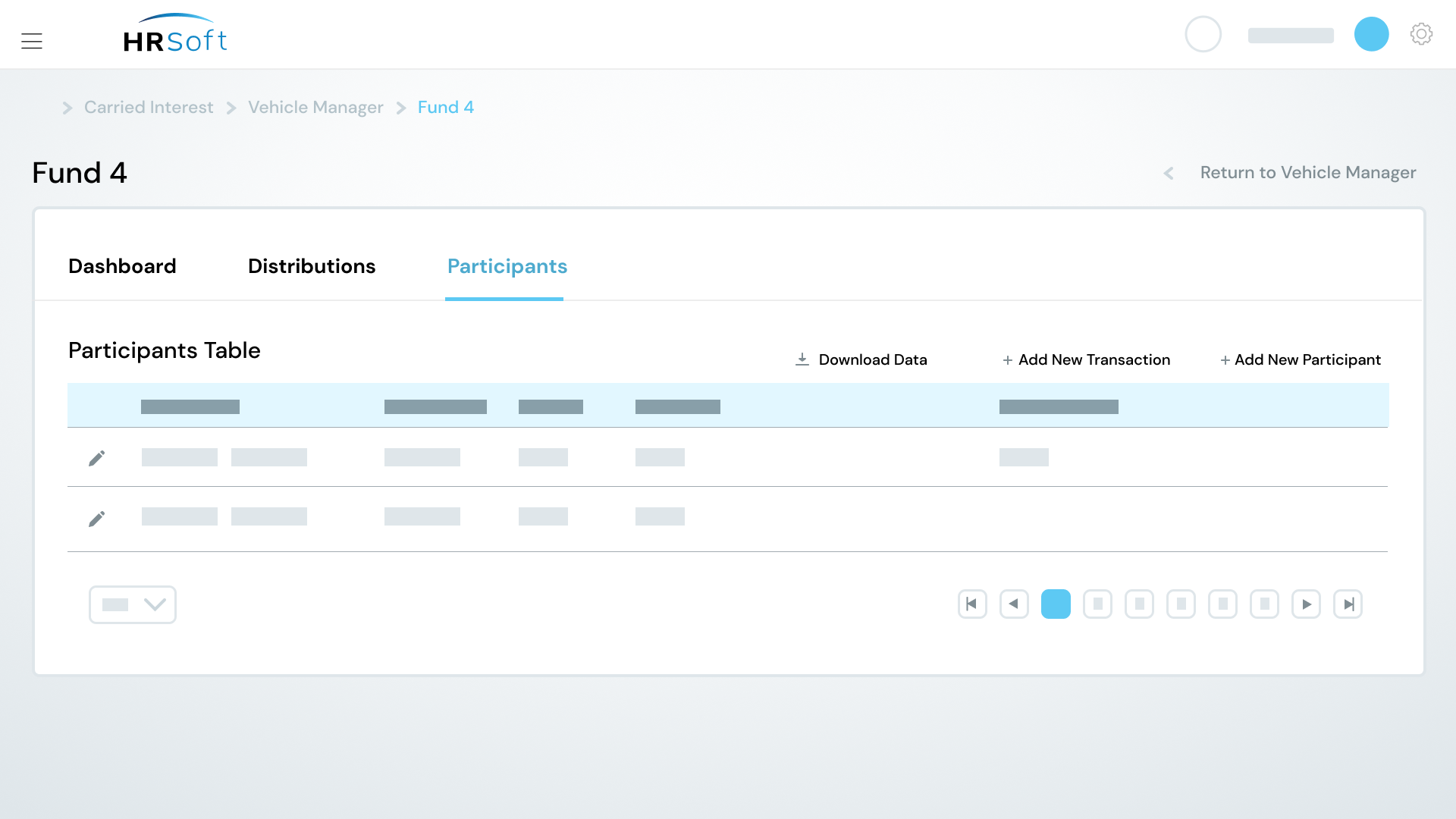

Provide GPs and participants with a single portal for live holdings, valuations, projections, and distributions. Delegate access and on-demand reporting to eliminate manual ad-hoc report requests and statement generation.

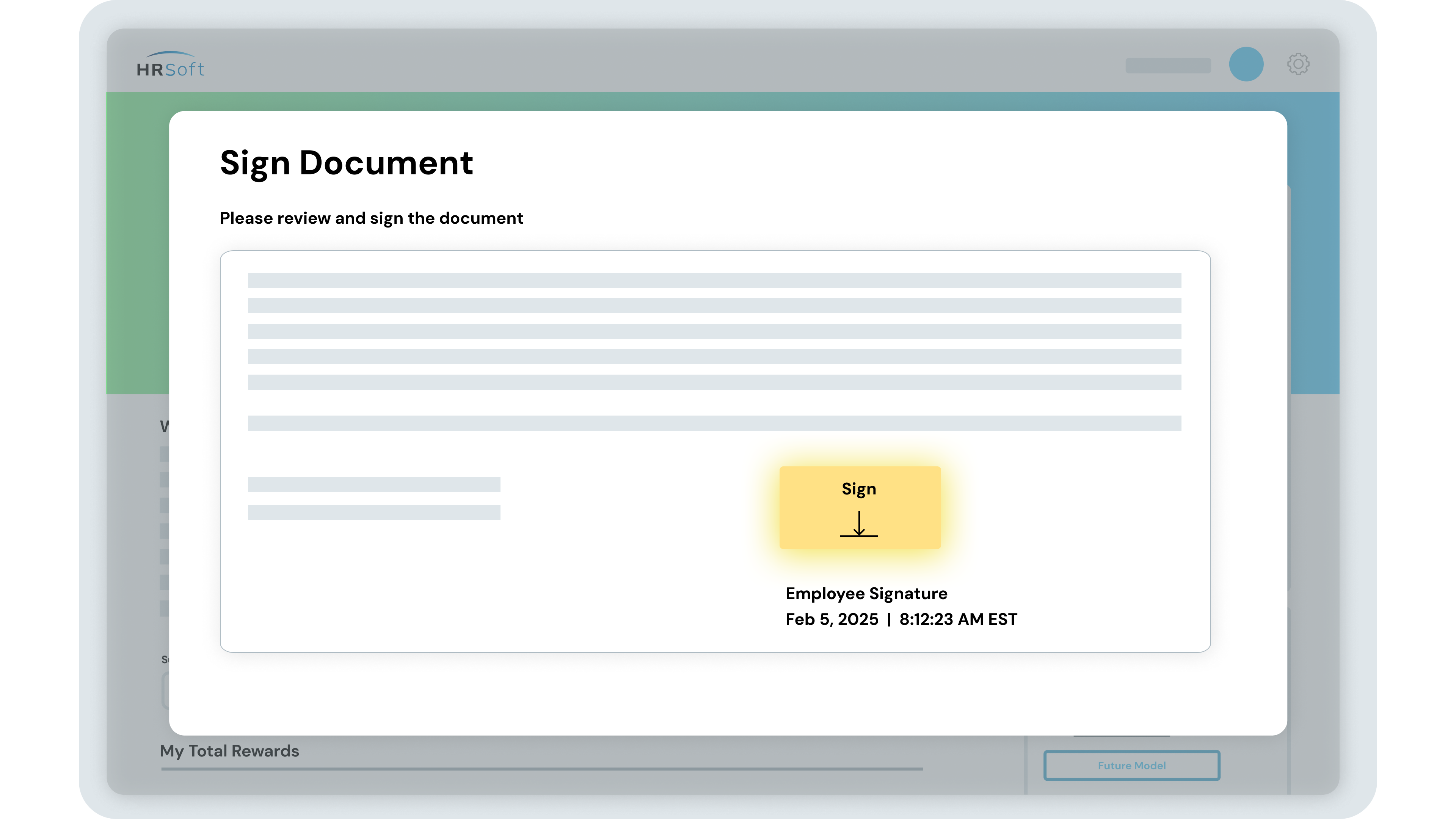

Managing carried interest doesn’t have to be complicated. HRSoft helps you keep everyone in the loop, from ownership tracking and participant communication to reporting and digital signatures.

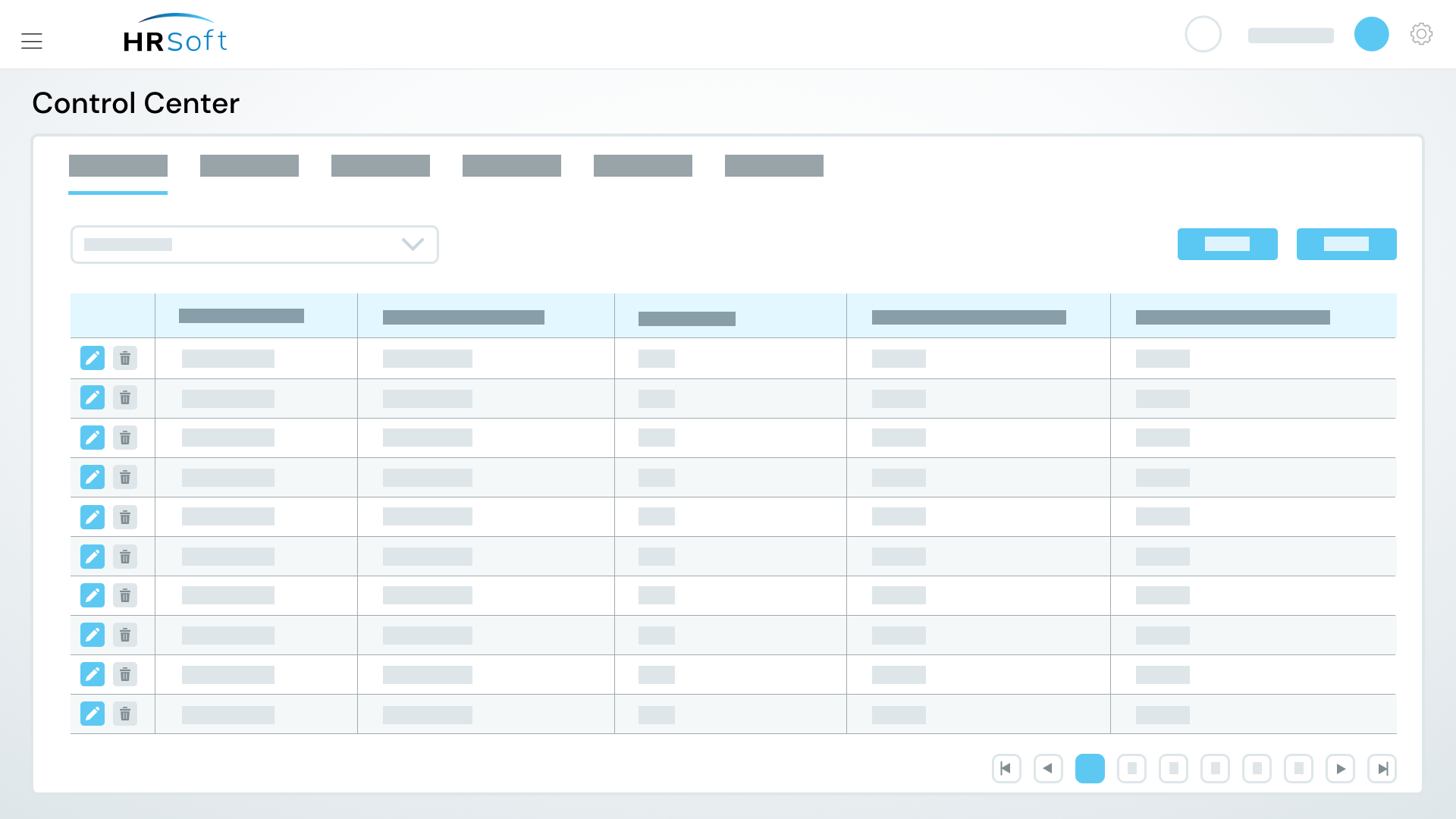

Manage ownership allocation and capital events while tracking your carried interest and co-invest programs with carried interest management software. Review details, update accounts and integrate new touchpoints.

Reduce the manual burden of report generation and processing with HRSoft. Our self-serve participant portfolio includes:

Each level of your firm needs specific data that answers their questions. HRSoft’s carried interest software for private equity and asset management has various options, including partner, fund and deal-level reporting.

Prepare forecasts and reports within one convenient platform and save data to be reviewed at a future date.

Easily get digital signatures for carried interest and partnership agreements with Docusign.

By transforming intricate financial data into transparent, actionable insights, HRSoft helps investment firms and financial services teams boost investor confidence.

PRIVATE EQUITY FIRMS

Private equity firms face particularly complex carried interest scenarios, with multiple fund vintages and tiered hurdle rates that demand precision. HRSoft automates these calculations to ensure accuracy and speed up reporting.

Manage intricate waterfall structures involving tiered hurdles, catch-up provisions and clawbacks

Automate carried interest allocation calculations to reduce costly errors

Accelerate reporting timelines for timely statements to limited partners (LPs)

Increase confidence in compensation models and strengthen investor relationships

VENTURE CAPITAL FIRMS

Venture capital firms juggle portfolios with many early-stage investments, each with unique timelines and exit scenarios. With HRSoft, firms have the flexibility to adapt calculations as deals evolve, offering clear visibility and timely updates.

Track fund performance in real time and adjust calculations based on deal outcomes

Handle diverse investments with varying timelines efficiently

Provide transparency and clear reporting to stakeholders

Make informed decisions on distributions, fostering trust between general partners (GPs) and LPs

REAL ESTATE FIRMS

Real estate firms often manage complex partnerships and joint ventures that involve preferred returns and tiered profit splits. HRSoft simplifies these complexities by accurately modeling and automating agreement terms.

Effectively manage preferred returns, tiered splits and catch-up mechanisms

Automate compliance and calculation processes to reduce administrative workload

Deploy capital faster with streamlined workflows

Enhance investor communication through accurate, timely reporting

Learn how the UK’s latest tax laws aim to change carried interest compensation and how the proposed strategy will impact capital firms.

We break down carried interest and why carried interest management software is becoming a game-changer for modern firms.

Learn how investment firms can attract top junior talent with tech-driven solutions, carried interest incentives and a values-based culture.

Give your team the tools they need to make better compensation decisions from day one.

HRSoft supports fund-level, deal-by-deal, tranche, vintage and hybrid plans.

Our highly configurable software can also be used for multiple vesting schedules, participant management, realization and distribution processing. Accommodate joiners and leavers within your plans and implement updates as needed.

Carried interest is a form of incentive compensation commonly used in investment management, particularly in private equity and venture capital settings. It operates by aligning the interests of investment managers with those of the investors in the fund they manage.

When investors pool their capital to form an investment fund, the managers use this capital to make investments across various assets with the aim of generating returns over a specified period. Carried interest is then calculated as a percentage of the fund’s profits, typically after a hurdle rate or preferred return for investors has been met.

This performance-based compensation model motivates managers to make sound investment decisions that surpass the hurdle rate, as they only receive carried interest when investments perform well. This setup fosters a direct financial stake for managers in the success of the investments, creating an alignment of interests between managers and investors.

When investments are liquidated, profits are distributed based on the fund’s agreement, with a portion going to investors and the remainder, including carried interest, shared between investors and managers.

Carried interest management software is a specialized tool designed to assist investment management firms in calculating, managing and tracking carried interest distributions. It streamlines the complex process of determining the share of profits that investment managers are entitled to receive based on the performance of the investment fund they manage.

The primary beneficiaries are the employees and the company’s stakeholders, including shareholders and investors. Employees benefit by receiving additional compensation tied to the company’s performance, which motivates them to work towards achieving higher returns. This structure also aligns the interests of employees with those of the company and its stakeholders, fostering a culture of accountability and performance-driven outcomes.

Carried interest is typically taxed as capital gains in many jurisdictions, including the United States. This means that the profits derived from carried interest are subject to the capital gains tax rate rather than the ordinary income tax rate. The rationale behind this tax treatment is that carried interest is seen as a return on investment or a share of the investment profits, similar to gains from buying and selling assets like stocks or real estate.

Carried interest is typically paid to investment managers or general partners (GPs) after certain conditions or milestones are met. It is usually linked to the performance of the investment fund they manage. The timing of carried interest payments can vary depending on the fund’s structure and the terms outlined in the agreement.

An employee works at an investment firm and manages a fund. Their contract says they get 10% of the fund’s profits as carried interest if it makes at least a 12% return for investors.

After three years, the employee’s fund has done really well and made $10 million in profit, exceeding the 12% target. After expenses, there’s $8 million left for distribution. The employee’s carried interest comes out to $800,000.

The firm gives $6 million to investors, the employee gets $800,000 as carried interest, and the rest covers fees and expenses.

Asset management involves overseeing and optimizing a portfolio of assets, such as stocks and bonds, to achieve specific financial goals. It includes activities like investment selection, portfolio diversification, risk management and performance monitoring to maximize returns while minimizing risks for investors or organizations.

Alternative investments are non-traditional assets that diverge from traditional stocks, bonds, and cash. They include investments like private equity, hedge funds and real estate, offering potential for higher returns but often with increased complexity and risk compared to traditional investments.